Real Estate and Construction Sector Decline Critically Hit Chinese Economy

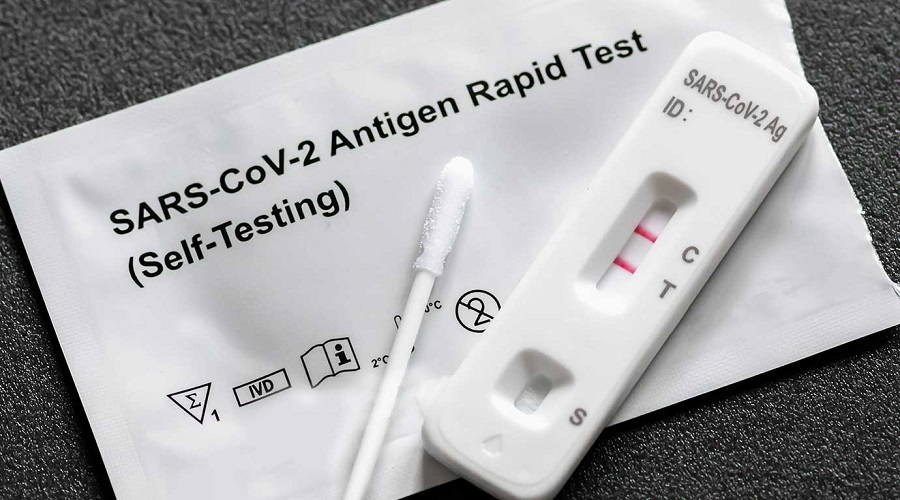

Last year, the economy of China moved at its slowest pace in the past 4 decades. A property crisis and COVID lockdowns massively hammered the country’s economy. However, the forecast-defeating reading enhanced hopes for a powerful recovery after its opening. The inflexible consent of Beijing to its zero-COVID policy of harder management effectively shut down the country.

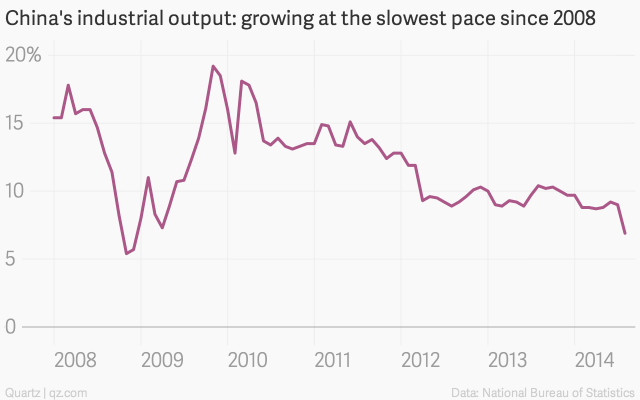

Meanwhile, the world hammered business activities in 2022 and kicked away the supply chains with the fluctuating global economy. Last year, their measures brought the growth to only 3%. It was the worst reading since a 1.6pc shrinking in 1976 just after the death of Mao Zedong. On Tuesday, the official of the National Bureau of Statistics, Kang Yi issued a press statement.

Yi said China is 2nd largest economy in the world but it experienced storms and massive waters in 2022. However, the figure also lost the 5.5pc target of the Chinese government and was well behind in the year 2021. But it was much more satisfactory compared to the 2.7pc predicted in a reputable survey. The reading of the 4th quarter of 2022 also surpassed forecasts providing some hopefulness for 2023.

The Unemployment Rate Dropped in December 2022

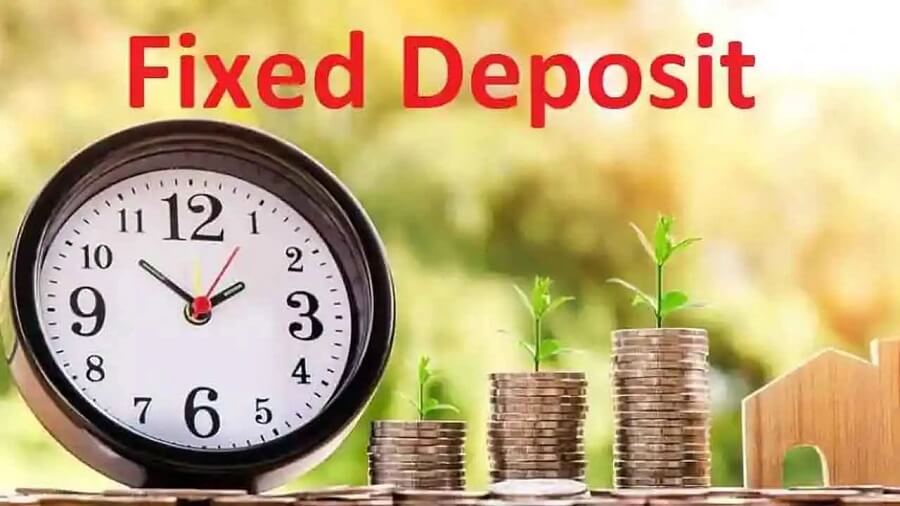

Moreover, retail sales dropped only 1.8pc in December to an earlier estimated 9pc. The swiping of restrictions enabled consumers to move around the high street. It is important that the unemployment rate dropped in December compared to November 2022. The fixed-asset investment and industrial output have also missed expectations. A senior economist at Oxford Economics, Louise Loo, issued a statement.

Loo said the good news has shown significant signs of stabilization. The policy support was furnished towards the end of last year. It has offered relative toughness in the credit growth and investment infrastructure. However, the Chinese economic distresses sent aftershocks across a global supply chain. The global supply chain is still struggling with dropping demand amid increasing inflation and Fed’s higher interest rates.

Major Shutdowns of Businesses and Manufacturing Facilities

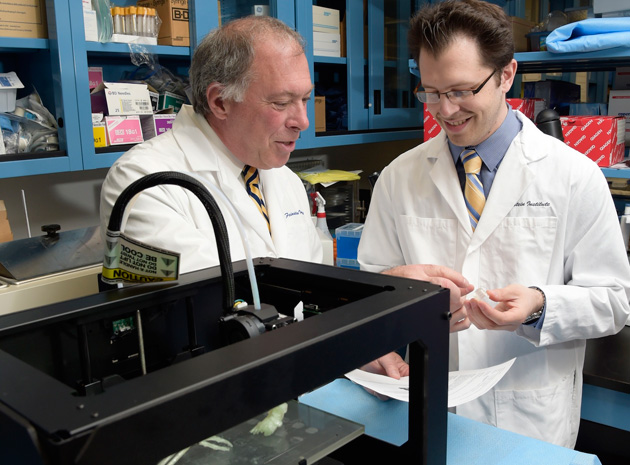

Meanwhile, strict quarantines, lockdowns, and essential mass testing triggered the harsh stoppages of businesses and manufacturing facilities in key hubs. Zhengzhou is the home of the largest iPhone factory in the world and it also experienced bad impacts. The country unexpectedly softened pandemic restrictions in December 2022 following some of the major protests in years.

The move of softening restrictions boosted the infection rate across the country. The move also sparked various concerns related to near-term impacts on the Chinese economy. The World Bank’s forecast shows the GDP of China is still below expectations and will spring back to 4.3pc in 2023. Meanwhile, various issues in the property sector are also impacting growth significantly.

The Real Estate Sector Sales Dropped in Various Cities

However, the property and construction sectors have decreased their contribution to the Chinese GDP by more than a quarter. Both sectors were critically impacted when Beijing began cracking down on extreme financing and unrestrained speculation in 2020. The regulation toughness marked the start of financial obstacles for Evergrande (a former Chinese number one real estate giant).

Evergrande is now struggling hard with a massive amount of debt. Meanwhile, the real estate business is still experiencing declining sales in various cities and most developers are struggling to prevail. But the Chinese government appeared to take a more gentle approach to prevail in the construction and real estate sectors.

Essential Measures to Motivate Stable & Healthy Development

The government announced various measures to encourage stable and healthy development in November. Those measures include better assistance for postponed payment loans for homebuyers and significant credit support for obligated developers. The chief economist for Greater China at HSBC, Jing Liu, said the path toward normalization is expected to become stony.

Liu also warned about a major setback in the near term amid a powerful bounce. The announcement of a series of measures would provide sufficient support to stabilize the real estate sector. She said it would also ensure massive funding support to developers and restore housing demand. However, Chaoping Zhu of JP Morgan Asset Management also suggested a sustained economic recovery in 2023.