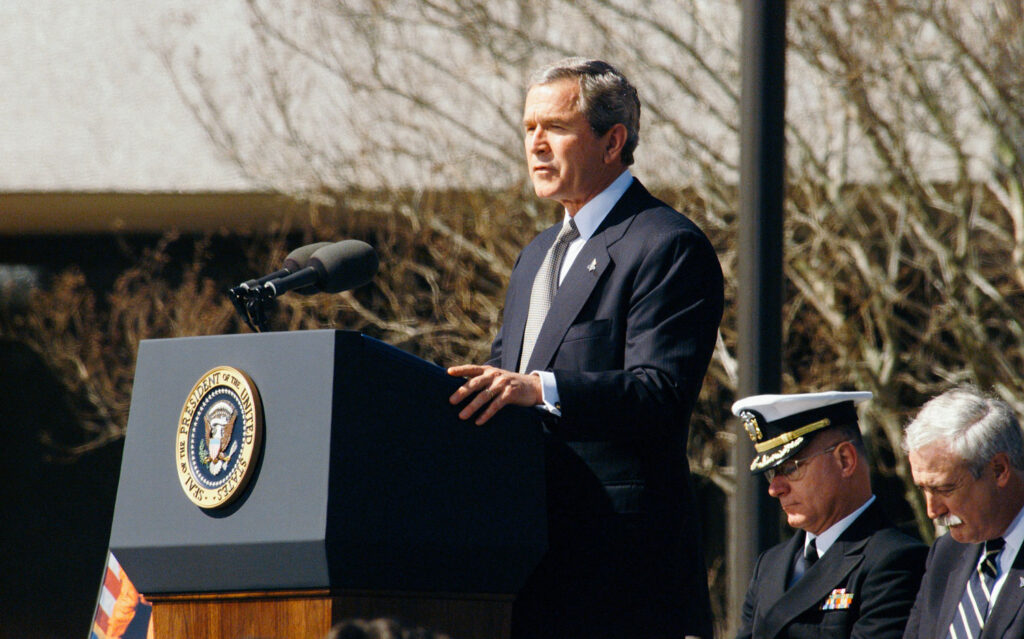

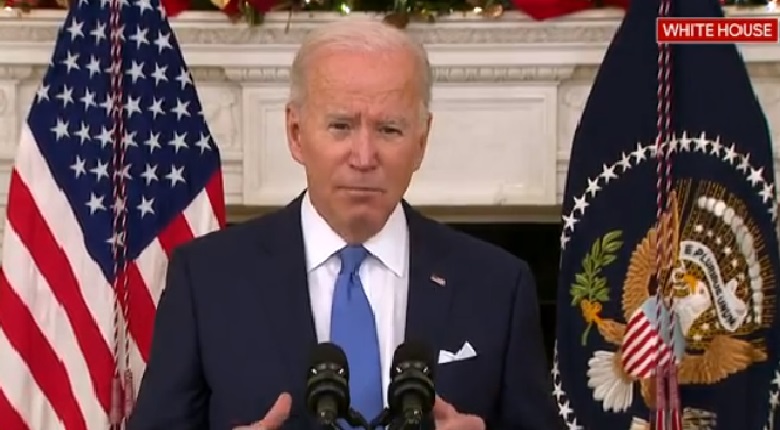

The White House Released Information about Crypto Regulation Framework

US President Joe Biden signed an executive order in March on Ensuring Responsible Development of Digital Assets. It directs the US federal government to study the mechanisms related to cryptocurrency. Government officials started research into the cryptocurrency industry 6 months after the executive order.

On Friday, the White House published its first-ever considerable framework for the responsible development of digital assets. Their groundwork pointed out the discoveries and suggestions from various government departments. Their report didn’t establish any new laws but provided a scenario of how the US will handle the crypto regulations.

Their framework includes protecting consumers, businesses, and investors. It will also promote access to safe, affordable financial services, and support financial stability. This groundwork also includes advancing responsible innovation and reinforcing our global financial leadership & competitiveness. It will enable the US in fighting illicit finance and exploring a US CBDC (Central Bank Digital Currency).

The SEC and CFTC will Enforce the Law

Meanwhile, this groundwork will authorize regulators to continue contriving efforts to impose the law in this sector. It will also enforce the law to exchange information on consumer complaints. The SEC (Securities and Exchange Commission) and the CFTC (Commodity Futures Trading Commission) are some of these regulators.

Moreover, the US Treasury would energetically involve financial institutions to help in detecting and reduce cyber-attack threats. The federal agency will engage them through data exchange and analysis. The Treasury was also asked to establish good coordination with the regulatory authorities. The agency will supposedly extend this essential responsibility to American partners.

The US Treasury Must Finalize its Evaluation

The international institutions include the OECD (Organization for Economic Co-operation and Development) and the FSB (Financial Stability Board). The Treasury must finalize its evaluation of the illicit financing-related threat with decentralized finance by February 28, 2023. The agency must also finish its assessment of non-fungible tokens in accordance with the recommendations.

Meanwhile, the Bank Secrecy Act includes regulations against tokens. The Act also features regulations against unlicensed money transmission particularly implement for providers of digital asset services. It includes digital asset exchanges and NFT (non-fungible token) platforms. President Biden will supposedly make a decision and ask Congress for its implementation.

The Supposed Alterations in the Bank Secrecy Act

The fact sheet has indicated that there were various options to ensure blockchain tech support of the net-zero emissions economy. It will supposedly help in increasing environmental justice. The sheet mentioned that President Biden is expected to ask Congress to alter the Bank Secrecy Act. His move will involve legislation against unlicensed money transmitting and its implementation specifically to digital asset service providers.

These digital asset service providers include the NFT (non-fungible token), digital asset exchanges, and others. Earlier this month, the White House Office of Science & Technology Policy issued a statement. It said crypto diggers must decrease greenhouse gas emissions. The statement suggested that Congress will supposedly determine legislation to eliminate or limit the high energy intensity harmony framework.

What is Crypto Bill?

Democrat Kirsten Gillibrand and Republican Cynthia Lummis proposed a bipartisan bill in June amid the crypto crash. The bill was presented following the growing conformity of institutional market participants asking for more sensible support to strengthen growth.

It is important that the country’s ability in regulating and innovation of the future of the digital economy is predominant. However, the divided and partisan state of the US government has endangered the financial leadership status of the country. It will supposedly generate catastrophic outcomes in the future.