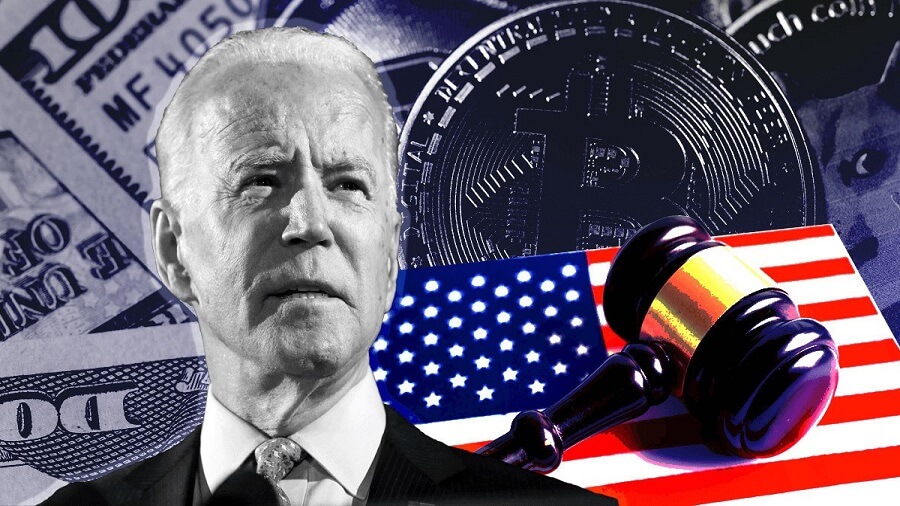

The Price of Bitcoin and other Famous Digital Currencies rose over $37,000

On Tuesday afternoon, Bitcoin trading has rushed back to $37,340 after subsequent days in the gloom. The CoinMarketCap reported that the recent move showed an increase of 3.8% over the last 24 hours. Moreover, the digital currency has shown a continuous climb throughout Tuesday after restoring losses on an unpredictable Monday afternoon. Bitcoin currency is still maintaining 46% below its 52-week high in November at around $69,000. Most of the cryptocurrency world has invoked after a significant number of declines during the last few days.

The recent evaporation came as the Federal Reserve meets today and Wednesday to address the US economy and when to increase interest rates as inflation rushes. It is noteworthy that cryptocurrency universally hit hard for the last couple of months. However, Ethereum evoked 5.4% over the past 24 hours, to a price of around $2,497. The 2nd largest cryptocurrency is still declining at more than 49% from 52-week commanding at around $4,900, as earned in November 2021, though decreased by around 32% in 2022.

Famous Digital Currencies Evoked including altcoins

Most of the famous altcoins have also been invoked over the past 24 hours. Avalanche rose at 13.5%, Solana increased 11.0%, Dogecoin raised at 9.0%, Binance Coin lifted 6.0%, XRP raised up 3.8%, and Terra accelerated at 1.8%. Most of the above-mentioned cryptocurrencies have shown an increase like Bitcoin relatively delicately on Tuesday. It is important that Bitcoin is soaring above 6-months lows. Early November, the Federal Reserve arranged a meeting with the central bank, which caused the price of Bitcoin to be under critical pressure.

At that time, the central bank announced the proposed start for lessening its purchases of bonds, decreasing incentives in the financial system. However, Bitcoin price has shown an increase and is doomed over the year 2021. It went doubled in value at the beginning of 2021 and then fell entirely to just mark the high in 2021. This trend showed a continuous decline in most of December and into January 2022. The digital currency dropped to around $33,000 in recent days after walking above in the 2nd half of December at $51,000.

Bitcoin hit 6-Months Lows

Moreover, Bitcoin is now trading above 6-month lows set on Monday after experiencing the recent decline. The Federal Reserve has also reduced incitement after the waves of price increase through the US economy. Our reliable sources also confirmed the Fed announced after the December meeting with the central bank that the momentum of its taper, purchasing fewer unbroken bonds anticipated in November 2021. The new momentum clearly indicates the Fed has planned to stop buying bonds by March 2022. The Fed has announced the planning for ultimately increasing interest rates.

The committee is expecting that it will be suitable to sustain this objective with eventually exceeding inflation at about 2%. The Federal Open Market Committee issued a statement that it will be relevant to sustain this goal until labor market conditions achieve consistent levels with the viewpoints of highest employment from the Committee. However, most market analysts are anticipating the Fed will boost interest rates at its meeting scheduled in March 2022. FedWatch Tool of CME indicates the cryptocurrency market is pricing at 88% possibility of the Fed increasing rates by 25-basis points with the 5% expectation of a 50-basis points slam.