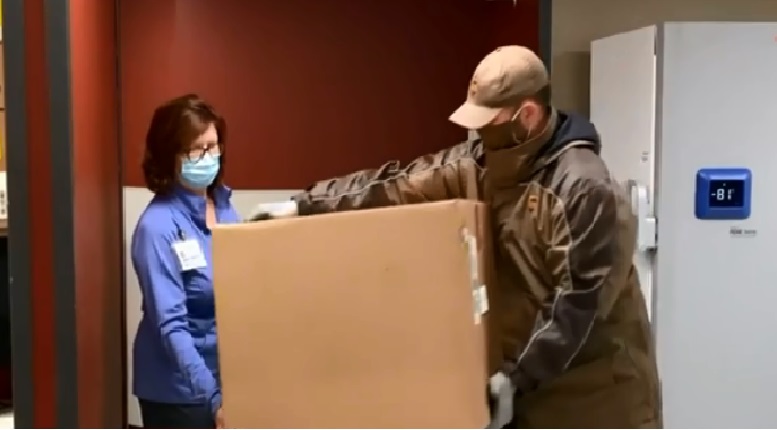

US Shipping Industry facing crisis while Businesses are rebuilding from Pandemic

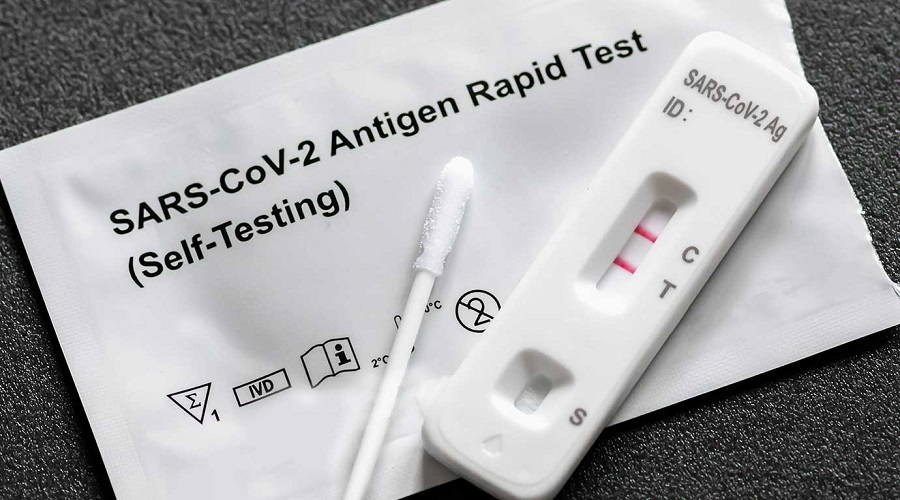

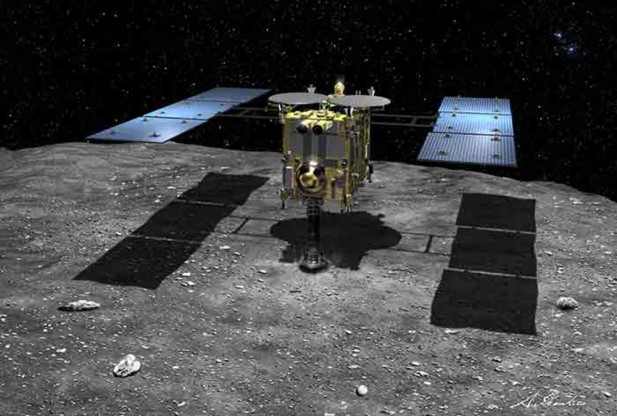

A number of shipping players control the majority of containers via giant vessels, leaving the world with fewer routes, fewer smaller ships, and fewer ports to keep the flow of goods moving. Alphaliner’s maritime data said the top 6 container operators control more than 70% of all container capacity. They are paying at least 4 times more to move their products compared with last year and face long delivery delays as businesses try to restock after the lifting of the Covid-19 restrictions. The owner of DeSales Trading Co., Mark Murry said, “A few years ago we would get a half-dozen competitive freight offers from shipping companies within a couple of hours. Now it’s a couple of days to get an offer from one of the big boys, you have to pay crazy freight rates and your shipment is months late. Our hands are tied”.

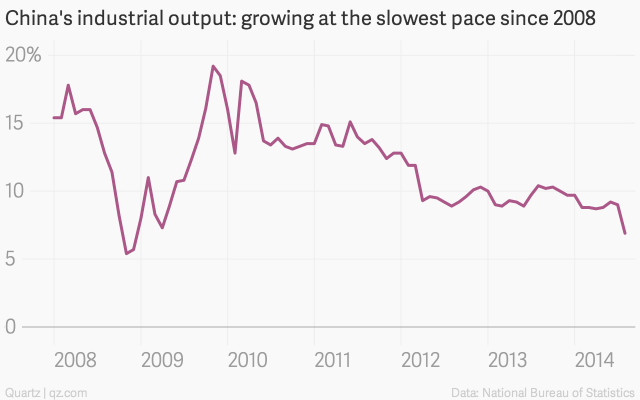

The shipping industry consolidated between 2016 and 2018 when a string of deals valued at around $14 billion cut the number of global box-ship operators by about half. The deal-making was part of efforts by ship-owners to cope with difficult conditions in the aftermath of the 2008 financial crisis. A surge in Asian manufacturing and demands by cargo owners to keep transport costs under control is among other factors driving the consolidation. The big liners have also formed 3 global alliances that share ships, cargo, and port calls. Some smaller operators have joined in giving those groups control over the vast majority of available capacity. The result was a streamlined system in which fewer, but bigger, ships called in at specific ports in Asia and then sailed to Europe or the US, carrying cargo that would go straight onto shelves or production lines.

Moreover, the new model cut waste from the system to limit unused space on ships and reduce warehousing expenses for importers. Covid-19 highlighted the fragility of the new supply-chain model in times of stress. Outbreaks over the summer at big export hubs like Yantian and Ningbo in China idled ships for weeks as they waited for terminals to reopen. After they sailed, they got stuck again at congested Western ports that couldn’t handle the cargo deluge. Unlike in the pre-consolidation era, when shippers could call on a range of small- and medium-size operators to help them manage through disruptions, cargo owners say they have largely had to choose between long waits and crippling costs. DeSales paid $9,500 to book the container, up from around $3,000 before the pandemic. The capacity crunch has led some shippers to hire their own vessels.