The Youth’s Guide to Investing in Stock Market

Building a financial cushion in the early stage often brings huge advantages for individuals and helps them to lead money situations in different scenarios. In today’s digital world, numerous attractive investment options are available for entry-level investors and allow small investments.

Thanks to technological advancements, stock market investing is convenient and attracts youth. Renowned discount brokerage firms have reduced investing costs with free demat accounts and stock market apps.

Beginners Guide to Invest in Stock Markets

There are a couple of crucial aspects that every investor should consider before starting the investing journey. Key aspects are explained below:

- Determine Financial Goals

Determine the financial goals before investing as stock market investments volatility may make investors nervous. Youngsters are tempted to prioritize spending their funds rather than paying attention to long-term goals. A financial plan with well-defined goals can help investors to stay on the right track. Investors should envision the short-term and long-term future and categorize financial objectives as short, mid, or long-term. They need to prioritize their financial goals based on need and want and set investment horizons.

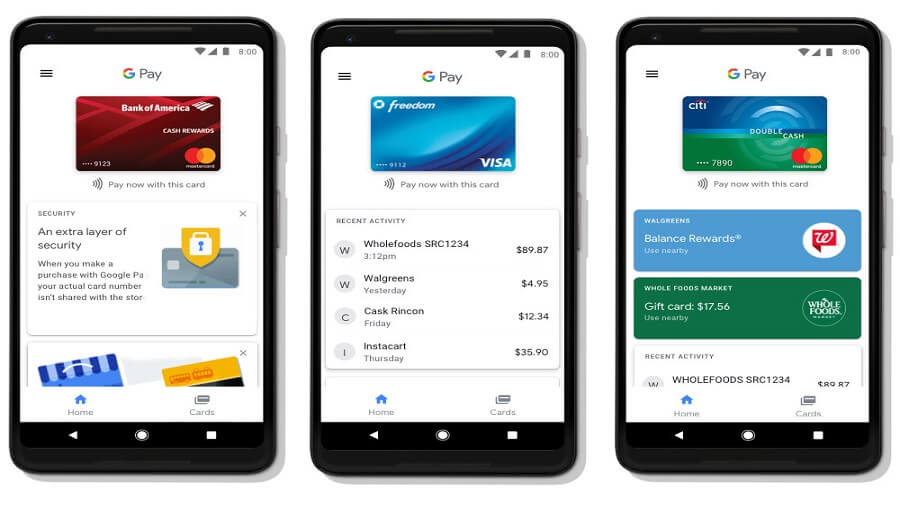

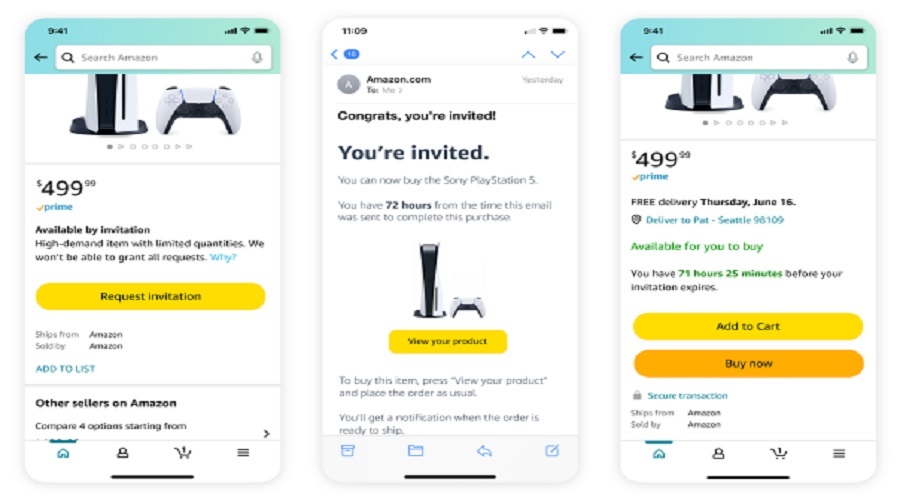

- Free Demat Account and Mobile Trading App

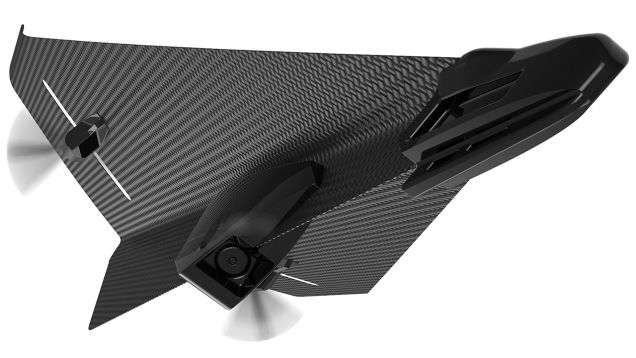

Stock market investments require opening a demat account with a stock broker registered with the SEBI (Securities Exchange Board of India). New investors may look to start investing with a small amount. Therefore, they prefer discount brokers offering free demat and trading accounts along with affordable brokerages. They provide advanced yet simple mobile trading apps with several beneficial features. One of these is upfront brokerage calculation. Other benefits include up-to-date research reports that can help investors to understand different market segments and current market trends to make informed decisions.

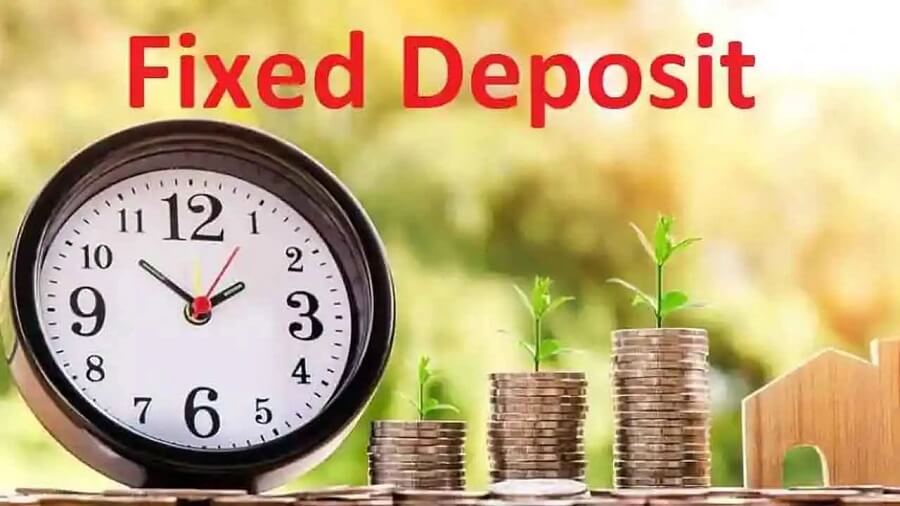

- Leverage the Power of Compounding

As investments grow over time, they can offer significant returns with the benefit of compounding. Compound interest and time work together to increase investment returns. Therefore, experts suggest investors start early and stay invested for the long term. As soon as one starts to earn, one can start investing. Investors prefer reinvesting those earnings to earn interest on interest and benefit from the compounding effect. Without any extra effort, investors can take advantage of the compounding effect on investment returns over a long period.

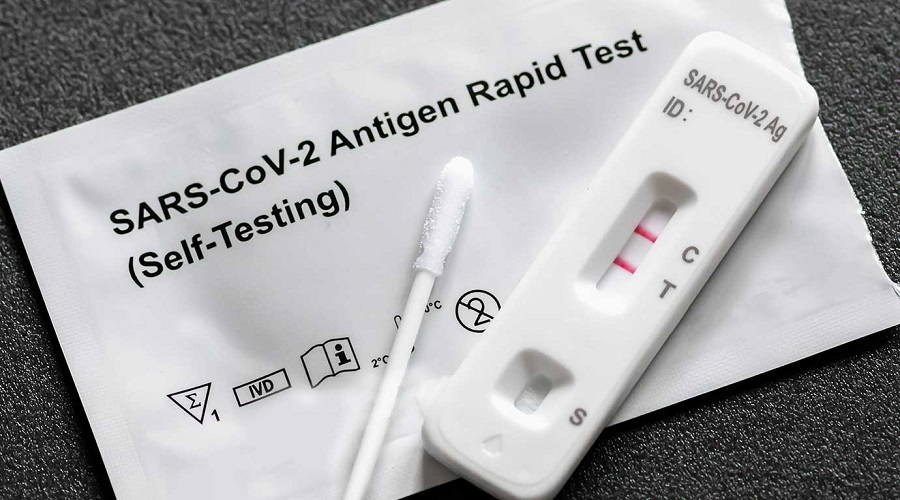

- Take Risk Tolerance into Account

Investors must gauge their risk tolerance before starting to invest. They should invest the money that they can afford to lose as stock markets are risky. Investors with more time to recoup losses, like those in their 20s or 30s, can consider direct equity investments.

- Benefit from Diversification

Diversification means investing in a mix of financial assets, like shares, bonds, alternative investments, etc. It helps investors to reduce overall risk in their investment portfolios. Aimed at easy investing, reputed discount brokers offer digital advisory services and curated ready-to-invest stock baskets diversified across industries. It can help novices significantly to diversify their portfolio.

- Review and Rebalance the Portfolio Periodically

Market conditions change over time, so investments in a portfolio. Investments grow at different paces in different market scenarios that may lead to imbalanced diversification or asset allocation a portfolio carries. Also, there can be increased income, a change in risk tolerance, and other scenarios. In such cases, investments may no longer remain aligned with their goals. At least an annual review of an investment portfolio is necessary to keep it in fine-tune.

This way, youth can be savers instead of spenders and connect their savings and financial goals. Most young investors are unlikely to be bound by family responsibilities. Therefore, they can easily spare at least 40-50% of their money to make investments. They just need to take care of their basic needs and wants. Download a mobile trading app to invest available funds at a convenient time.